What does the Biden presidency mean for the dollar?

After four turbulent years, the Trump era comes to an end.

During a term defined by the trade war with China, lower taxes, and near-constant domestic controversy, the Dollar quietly ticked upwards until the COVID-19 crisis caused a 7% slide in 2020. With a new administration headed to the White House this month and a continuing pandemic, what does the forecast for the Dollar look like in 2021?

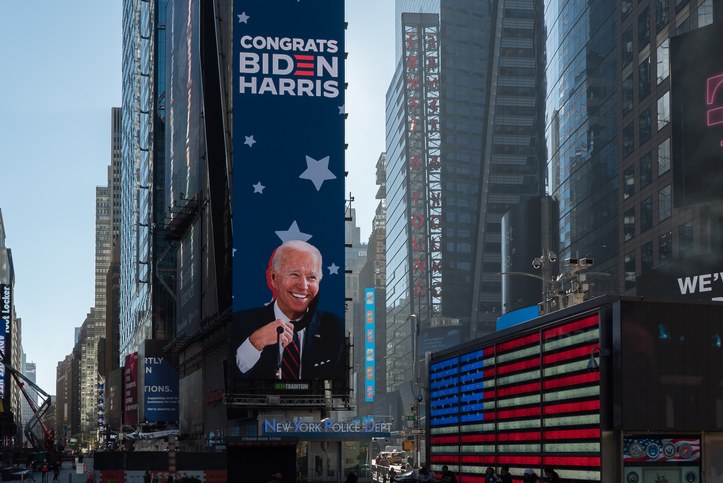

As of January 20, 2021, Joe Biden will be President. He and the Democrats will have the support of the House of Representatives and the Senate, after Democrats took both of Georgia’s Senate seats in runoff elections, meaning he will have essentially free reign to enact his domestic agenda.

In the short term, this means two things. Firstly, the Dollar regains some of its reputation as a safe haven asset, thus driving up its value, and should now be less volatile due to a more stable government both in terms of legislative ability and the reduced controversy surrounding the Commander-in-Chief. Secondly, the Democrats will be able to pass a much more comprehensive and robust COVID-19 recovery/stimulus package than could have been achieved in a compromise with Republicans, again buoying the economy and the Dollar in turn.

However, the Dollar’s reputation as a safe haven for investors has seen its value fall in post-crisis times, as investors move away from it as economies elsewhere improve and opportunities open up. Thus, it is possible that as vaccines roll out the Dollar may begin a long fall in the back half of 2021, similar to the slide that began in 2001 and ended with the 2008 financial crisis. Only time will tell whether this bares out, as the COVID-19 crisis is unique in many ways and its effects on markets are not always obvious.

On the other side, there is the potential for further unrest from disgruntled Trump supporters such as the recent incident at the Capitol. Much will depend on what Trump does after he leaves power. Despite his banning from various social media platforms, he still has a large base that is simultaneously separate from the Republican Party, in that they support Trump directly and do not answer to the institution itself; and enmeshed within it as a significant minority of Congresspeople and Senators break from the party line and support his claim that the election has been stolen. This will likely cause further unrest over the coming months, which could cause day-to-day volatility in Dollar markets.

This complex mixture of factors means that investing in the Dollar and hoping for safety and stability may not be as advisable as in past years. While there are reasons to be hopeful for a return to the stable and safe reputation of the Dollar, this is unlikely to appear in the short term. The overall picture will become clearer throughout the year, so keep an eye out for indicators of where the Dollar is headed in 2021.